Indeed all praises are due to Allah, we praise Him, we seek His help, we ask for His forgiveness, and we rely solely on Him. We seek His refuge from the evil in our souls and from our wicked deeds. Whoever Allah guides, no one can misguide. And whomever Allah misguides, no one can guide. I bear witness that there is no one worthy of worship except Allah, He is One, with no partners, and I testify that Mohammad (ﷺ) is His Messenger and His slave.

This article is published in 6 parts:

- Introduction & General Rules: Inheritance in Islam (1)

- Primary Heirs: Inheritance in Islam (2)

- Secondary Heirs: Inheritance in Islam (3)

- Other Rules: Inheritance in Islam (4)

- Share Distribution & Examples: Inheritance in Islam (5)

- Islamic Will: Inheritance in Islam (6)

- Conclusion: Inheritance in Islam (7)

PART 5: SHARE DISTRIBUTION & EXAMPLES

Share Matrix

Summary of Fixed Sharers of Primary heirs:

Following map illustrates the shares of 5 primary heirs that always gets their share, these include

- Father

- Mother

- Husband

- Wife

- Daughters

FIXED SHARERS OF PRIMARY HEIRS |

|||

HEIR |

RULE |

SHARED AS |

ALLOCATION |

| FATHER | 1. Deceased has son or son’s son etc | Dhul-Fard (ذو الفرض) | 1/6 |

| 2. Deceased has no son or son’s son, but has Daughter or Son’s Daughter etc | Dhul-Fard & Asabah (ذو الفرض و العصبة) | 1/6 + remaining from Dhul-Fard | |

| 3. Deceased has no child | Asabah only (العصبة) | Remaining from Dhul-Fard | |

| MOTHER | 1. Deceased has no child, neither had 2 or more brother/sisters | Dhul-Fard (ذو الفرض) | 1/3 |

| 2. Deceased has child or had 2 or more brother/sisters | Dhul-Fard & Asabah (ذو الفرض) | 1/6 | |

| 3. Deceased had only parents and wife | Dhul-Fard & Asabah (ذو الفرض) | 1/4 | |

| 4. Deceased had only parents and husband | Dhul-Fard & Asabah (ذو الفرض) | 1/6 | |

| HUSBAND | 1. Deceased has no child or no son’s son or no son’s daughter | Dhul-Fard (ذو الفرض) | 1/2 |

| 2. Deceased has child or son’s son or son’s daughter | Dhul-Fard (ذو الفرض) | 1/4 | |

| WIFE | 1. Deceased has no child or no son’s son or no son’s daughter | Dhul-Fard (ذو الفرض) | 1/4 |

| 2. Deceased has child or son’s son or son’s daughter | Dhul-Fard (ذو الفرض) | 1/8 | |

| DAUGHTER | 1. Deceased has only one daughter and no son | Dhul-Fard (ذو الفرض) | 1/2 |

| 2. Deceased has two or more daughters and no son | Dhul-Fard (ذو الفرض) | 2/3 jointly share | |

| 3. Deceased has son(s) and daughter(s) | Al-Asabah bighayriha (عصبة بغيرها) | 1/2 of son | |

Some other rules and exceptions may apply. See other sections.

Summary of Remaining Sharers of Primary heirs

Following map illustrates the shares of remaining primary heirs, these include

- Real Grandfather (father’s father)

- Uterine Sister (half-sister from mother’s side)

- Uterine Brother (half-brother from mother’s side)

- Granddaughter (Son’s Daughter)

- full Sister

- Consanguine sister (half-sister from father’s side)

- True Grandmother (mother of father or mother)

REMAINING SHARERS OF PRIMARY HEIRS |

|||

HEIR |

RULE |

SHARED AS |

ALLOCATION |

| REAL GRAND FATHER (FATHER'S FATHER) | 1. Deceased has father, who is present | Totally Excluded (حجب حرمان) OR (محجوب) | Blocked by father |

| 2. Deceased has no father and no child | Asabah only (العصبة) | Gets remaining residue | |

| 3. Deceased has no father and has son or son’s son etc | Dhul-Fard (ذو الفرض) | 1/6 | |

| 4. Deceased has no father and no son and no son’s son, but has daughter(s) or son’s daughter (s) | Dhul-Fard & Asabah (ذو الفرض و العصبة) | 1/6 + remaining residue/td> | |

| UTERINE SISTER & BROTHER (MOTHER'S SIDE) | 1. if deceased is not Kalala, i.e. deceased has ascendants or descendants | Totally Excluded (حجب حرمان) OR (محجوب) | Blocked by child or father or gf |

| 2. Deceased has only one uterine sister or brother | Dhul-Fard (ذو الفرض) | 1/6 | |

| 3. Deceased has more than one uterine sister(s) or brother(s) | Dhul-Fard (ذو الفرض) | 1/3 shared jointly | |

| GRAND DAUGHTER (SON'S DAUGHTER) | 1. Deceased has Son or two or more Daughters | Totally Excluded (حجب حرمان) OR (محجوب) | Blocked by child |

| 2. If not #1, and Only one Grand daughter | Dhul-Fard (ذو الفرض) | 1/2 | |

| 3. If not #1, and more than one Grand daughters | Dhul-Fard (ذو الفرض) | 2/3 shared jointly | |

| 4. If not #1, and One Daughter with more than one Grand daughters | Dhul-Fard (ذو الفرض) | 1/6 shared jointly by GD | |

| 5. If not #1, and there are Grandson (Son’s son however low in hierarchy) with Grand Daughters | Al-Asabah bighayriha (عصبة بغيرها) | Half of Grandson’s share | |

| FULL SISTER | 1. if deceased is not Kalala, i.e. deceased has ascendants or descendants | Totally Excluded (حجب حرمان) OR (محجوب) | N/A |

| 2. If not #1, and Only one Full Sister | Dhul-Fard (ذو الفرض) | 1/2 | |

| 3. If not #1, and more than one Full Sister | Dhul-Fard (ذو الفرض) | 2/3 shared jointly | |

| 4. If not #1, and there are Full Brother with Full Sister | Al-Asabah bighayriha (عصبة بغيرها) | Half of Brother’s share | |

| 5. If not #1, and there is Daughter or Grand Daughter (Son’s Daughter) | Al-Asabah ma’a ghayriha (العصبة ما غيرها) | Remain of Dhul-Fard | |

| CONSANGUINE SISTER (HALF-SISTER FROM FATHER'S SIDE) | 1. if deceased is not Kalala, i.e. deceased has ascendants or descendants. OR (there if Full Brother), OR (two Full Sisters) OR (One Full Sister and Granddaughter (son’s daughter) | Totally Excluded (حجب حرمان) OR (محجوب) | Blocked |

| 2. If not #1, and Only one Consanguine Sister | Dhul-Fard (ذو الفرض) | 1/2 | |

| 3. If not #1, and more than one Consanguine Sister | Dhul-Fard (ذو الفرض) | 2/3 shared jointly | |

| 4. If not #1, and there are Consanguine Brother with Consanguine Sister | Al-Asabah bighayriha (عصبة بغيرها) | Half of Brother’s share | |

| 5. If not #1, and Consanguine Sister with One Full Sister | Dhul-Fard (ذو الفرض) | 1/6 fixed | |

| 6. If not #1, and there is Daughter or Grand Daughter (Son’s Daughter) with Consanguine Sister | Al-Asabah ma’a ghayriha (العصبة ما غيرها) | Remain of Dhul-Fard | |

| REAL GRAND MOTHER (MOTHER OF FATHER/OR MOTHER) | 1. Deceased has mother, who is present | Totally Excluded (حجب حرمان) OR (محجوب) | Blocked by mother |

| 2. If not #1, and has one Real Grandmother | Dhul-Fard (ذو الفرض) | 1/6 | |

| 3. If not #1, and has more than one Real Grandmother | Dhul-Fard (ذو الفرض) | 1/6 shared jointly | |

Share Distribution - Step by Step

- Step # 1 - Identify Heirs: Identify Members of Dhul-Furud (ذو الفروض) include 12 members, these include:

- Group 1 - Fixed Shares Group: 1) Father 2) Mother 3) Husband 4) Wife 5) Daughters:

- Group 2 - Varying Share Group: 6) Real Grandfather (father’s father) 7) Uterine Sister (half-sister from mother’s side) 8) Uterine Brother (half-brother from mother’s side) 9) Granddaughter (Son’s Daughter) 10) full Sister 11) Consanguine sister (half-sister from father’s side) 12) True Grandmother (mother of father or mother)

- Step # 2 - Apply Impediment: Exclude any one who is disqualified due to any impediment.

- Step # 3 - Group of Five: First consider Group-of-Five (G5) who always inherits & assign the shares of Group-of-Five:

- Wife: If deceased is Husband, then assign Wife (ves) their share (either 1/4 or 1/8)

- Husband: If deceased is Wife, then assign Husband his share (either 1/2 or 1/4)

- Uterine Brother: If deceased is Kalala and has Uterine Brother, then give him his share (either 1/6 or 1/3)

- Uterine Sister: If deceased is Kalala and has Uterine Sister, then give her share (either 1/6 or 1/3)

- Real Grandmother: If deceased has no mother but has Grandmother(s), then give them share (1/6)

- Step # 4 - Group of Seven: Second Consider Group–of-Seven (G7) and Assign the shares of Group-of-Seven:

- Mother: If deceased has a mother, then give her share (1/3 or 1/4 or 1/6)

- Father: If deceased has a father, then give her share (1/6 or 1/6+Residue or all residue)

- Real Grandfather: if decease has no father, then give grandfather his share (same as father)

- Daughter: if deceased has daughter, then give her share (1/2 or 2/3 or half of son)

- Please note, If there is a son, then Daughter is treated as a Secondary Heir (Residuary) / Al-Asabah bighayriha (العصبة بغيرها), i.e. Asabah because of others, and she gets half of son’s share.

- Full Sister: if deceased is Kalala and has a full sister and she is entitled, then give her share (1/2 or 1/3 or half of brother or residue)

- Please note, If there is a full-brother, then Full-Sister is treated as a Secondary Heir (Residuary) / Al-Asabah bighayriha (العصبة بغيرها), i.e. Asabah because of others, and she gets half of brother’s share.

- If there is and there is Daughter or Grand Daughter (Son’s Daughter) then Full-Sister is treated as a a Secondary Heir (Residuary) / Al-Asabah ma’a ghayriha (العصبة ما غيرها), i.e. Asabah together with other.

- Consanguine Sister: if deceased has consanguine sister and she is entitled, then give her share (1/2 or 1/3 or half of brother or residue)

- Please note, If there is a Consanguine brother, then Consanguine Sister is treated as a Secondary Heir (Residuary), and she gets half of Consanguine Brother’s share.

- Step # 5 - Add all shares of Primary Heirs: Add up shares of Dhul-Furud (ذو الفروض) Primary Heirs,

- When distributing shares amongst Dhul-Furud (ذو الفروض), we will encounter one of the following situations

- When total allocation of shares equals 1, then No further action is needed.

- When total allocation of shares is greater than 1, then we apply Doctrine of Al-Awl

- When total allocation of shares is less than 1, then we apply Doctrine of Al-Radd

- Please note that before apply Doctrine of Al-Radd, we need to distribute shares amongst Residuaries (both Nasabiyyah and Sababiyyah)

- If after giving all the shares to Residuaries, any residue is still left, then Doctrine of Al-Radd is applied

- When distributing shares amongst Dhul-Furud (ذو الفروض), we will encounter one of the following situations

- Step # 6 - Identify Residuaries (Secondary Heirs): Identify if there is Residue.

- If after assigning shares of Dhul-Furud (ذو الفروض) there is any residue left, then it should be further distributed amongst Secondary Heirs.

- Step # 7 - Assign Residuaries (Secondary Heirs: Identify and Assign Shares of Al-Asabat Nasabiyyah (العصبات نسبية) – Secondary Hiers (Residuary),

- First, identify Descendants of Deceased i.e.

- Son

- Daughter (when daughter is accompanied by son)

- Grandson (Son’s Son)

- Granddaughter (Son’s Daughter, when accompanied by grandson and however low in hierarchy)

- Secondly, identify Ascendant of Deceased, (if there is still residue) i.e.

- a. Father (if father was treated as residuary)

- True grandfather (however high in chain, if GF is treated as residuary)

- Thirdly, identify Ascendant of Father, (if there is still residue) i.e. six siblings

- Full Brother

- Full Sister (when she is treated as residuary)

- Consanguine Brother

- Consanguine Sister (when she is treated as residuary)

- Full brother’s Son (however low in chain)

- Consanguine brother’s son (however low in chain)

- Lastly, identify Ascendant of Grandfather, (if there is still residue) i.e. uncles or granduncles Offspring of true grandfather (father’s father, however high in hierarchy)

- Paternal uncle

- Male descendants of paternal uncle

- First, identify Descendants of Deceased i.e.

- Step # 8 - Identify any pending Residue: Identify if there is still Residue & Assign to Dhawul-Arham (ذو الرحام) - Distant kindred,

- If after assigning shares of Al-Asabat Nasabiyyah (العصبات نسبية) there is any residue left, then it should be further distributed amongst Dhawul-Arham (ذو الرحام) - Distant kindred

- Distribution is similar to Nasabbiyyah but for female agnates and those residuaries who are not in Nassabbiyyah:

- Descendants of the deceased (who are excluded from residuaries). (Children of daughter(s)).

- Ascendants of the deceased (who are excluded from residuaries)

- Descendants (however low in chain) of the siblings of the deceased. (children of sister(s), daughter(s) of brothers, and son(s) of half sister on mother side etc)

- Descendants (however low in chain) of ascendants (uncles/aunts)

- Step # 9 - Identify if there is still Residue left: Identify if there is still Residue,

- If there is still residue, then apply Doctrine of Al-Radd

- Step # 10 - Identify if there is still Residue:

- If there is still residue, then it will go to Bait-ul-Maal

- Few contemporary Ahnaf considered giving Al-Radd can be given to spouse (husband/wife), however, the Doctrine of Al-Radd is based on Quranic verse (33:6), that only allows giving Al-Radd to blood relatives (hence keeping spouse disqualified from it).

EXAMPLES

Four situations while dividing shares

When distributing shares, we encounter four main situations

- Inheritance is distributed only amongst Dhul-Fard (ذو الفرض)

- Inheritance is distributed amongst Dhul-Fard (ذو الفرض) and Al-Asabat Nasabiyyah (العصبات نسبية)

- Inheritance is distributed only amongst Al-Asabat Nasabiyyah (العصبات نسبية)

- Inheritance is distributed amongst Dhawul-Arham (ذو الرحام)

A. INHERITANCE IS DISTRIBUTED ONLY AMONGST DHUL-FURUD (ذو الفروض)

Examples of Al-Radd

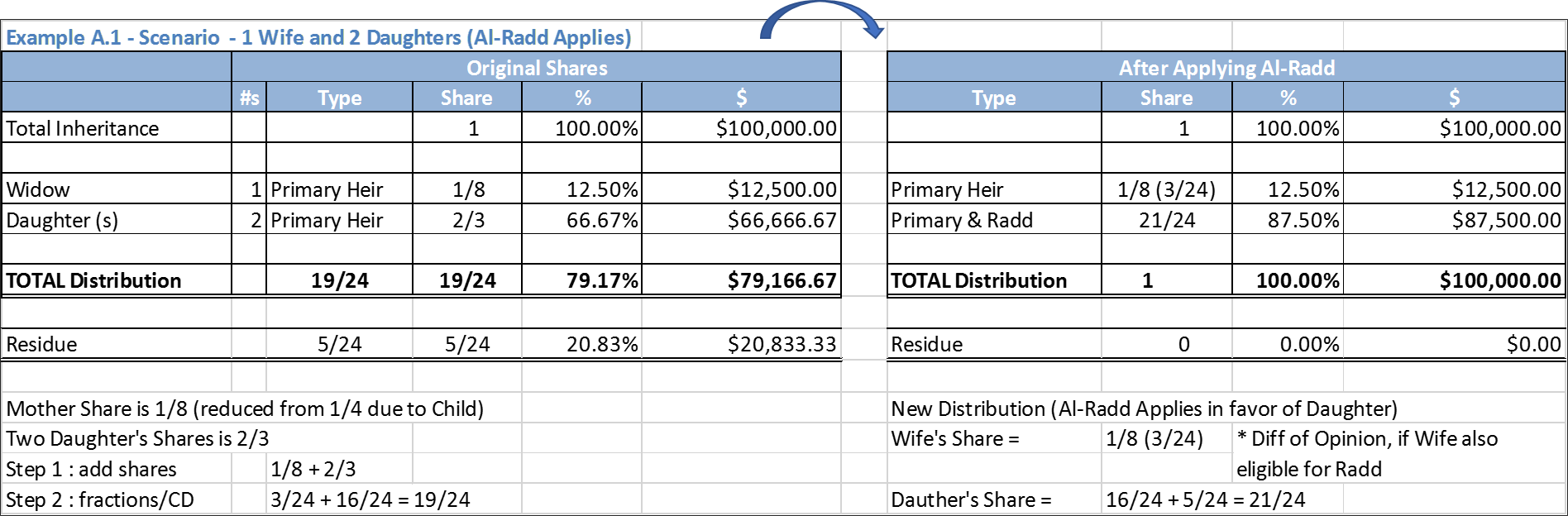

A.1 Example: Wife, 2 Daughters

- Heirs are: 1 Wife and 2 Daughters (Al-Radd Applied)

- Total Estate for inheritance is $100,000

- Widow’s regular share is 1/4, but due to child her share is 1/8 ($12,500)

- Daughter regular share is 1/2, but 2 daughters’ share 2/3 ($66,666.67).

- Total shares (1/8+2/3) = 19/24 ($79,166.67). Here Residue (left over) is 5/24 ($20,833.33).

- Based on this example Doctrine of Al-Radd applies.

A.1 Example: Al-Radd Applied

- Wife is excluded from Al-Radd and total Residue was returned to Daughters. There is difference of opinion if Wife gets al-Radd. One group states that all Quranic Heirs are eligible for Al-Radd (include Usman bin affan), others have differing views (include Abdullah bin Masood and Abdullah bin Abbas) (ra).

- Daughters get additional residue of 5/24 making their total share as 21/24 (i.e. 16/24+5/24).

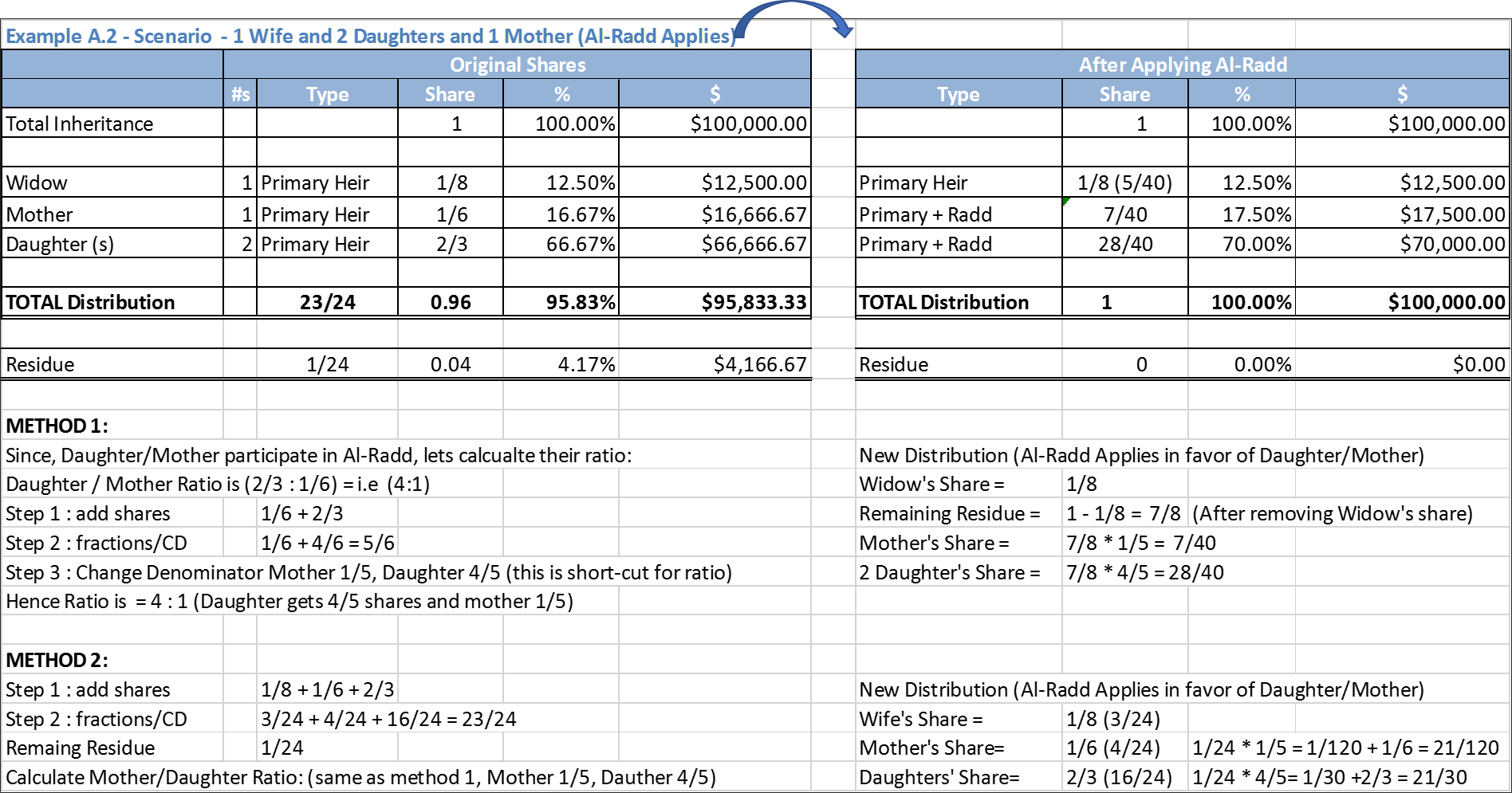

A.2 Example: Wife, 2 Daughters, 1 Mother

- Heirs are: 1 Wife and 2 Daughters and 1 Mother(Al-Radd Applied)

- Total Estate for inheritance is $100,000

- Widow’s regular share is 1/4, but due to child her share is 1/8 ($12,500)

- Mother share is 1/6 due to child ($16,666.67)

- Daughter regular share is 1/2, but 2 daughters’ share 2/3 ($66,666.67).

- Total shares (1/8+1/6+2/3) = 23/24 ($95,833.33). Here Residue (left over) is 1/24 ($4,166.67).

- Based on this example Doctrine of Al-Radd applies and residue 1/24 is returned to blood relative who in this case is Mother and Daughter based on their original ratio. Widow is excluded from Al-Radd as she is not Blood relative.

A.2 Example: Al-Radd Applied

- Calculate the Ratio of Mother and Daughter first (See Above). Ratio is 1:4

- After giving Widow’s Fixed Share (1/8), Residue is 7/8.

- Mother gets 7/40 (7/8 * 1/5) = $17,500

- Daughters 28/40 (7/8 * 4/5) = $70,000

- Please note, we can also apply ratio to 1/24, i.e. Daughter additional share would be (1/24 * 4/5 = 1/30), then add 1/30 + 2/3 = 21/30 (or 28/40). We can calculate either way

Examples of Al-Awl

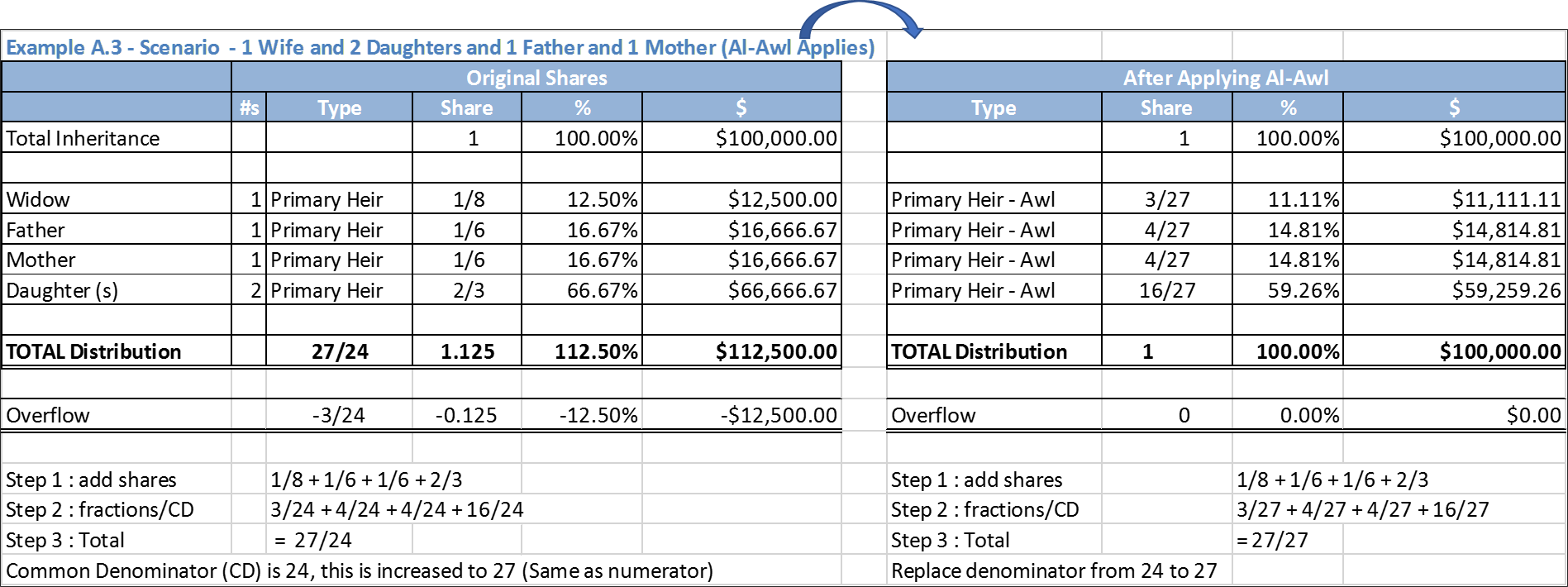

A.3 Example: Wife, 2 Daughters, 1 Mother, Father

- Heirs are: 1 Wife and 2 Daughters and 1 Mother and Father (Al-Awl Applied)

- Total Estate for inheritance is $100,000

- Widow’s regular share is 1/4, but due to child her share is 1/8 ($12,500)

- Mother’s share is 1/6 due to child ($16,666.67)

- Father’s share is 1/6 due to child ($16,666.67)

- Daughter regular share is 1/2, but 2 daughters’ share 2/3 ($66,666.67).

- Total shares (1/8+1/6+1/6+2/3) = 27/24 ($112,500). Here Overflow is 3/24 ($12,500).

- Based on this example Doctrine of Al-Awl applies and we reduce the shares of heirs according to their share proportion.

A.3 Example: Al-Awl Applied

- Calculate Shares (See Above). Since total shares are 27, we change numerator to 27. After that we simply apply new fractions to their shares to reduce their shares

- Please see this example in light of “A.2 Example: Wife, 2 Daughters, 1 Mother”, that by adding father we changed the scenario to Al-Awl instead of Al-Radd.

Examples of Even Shares

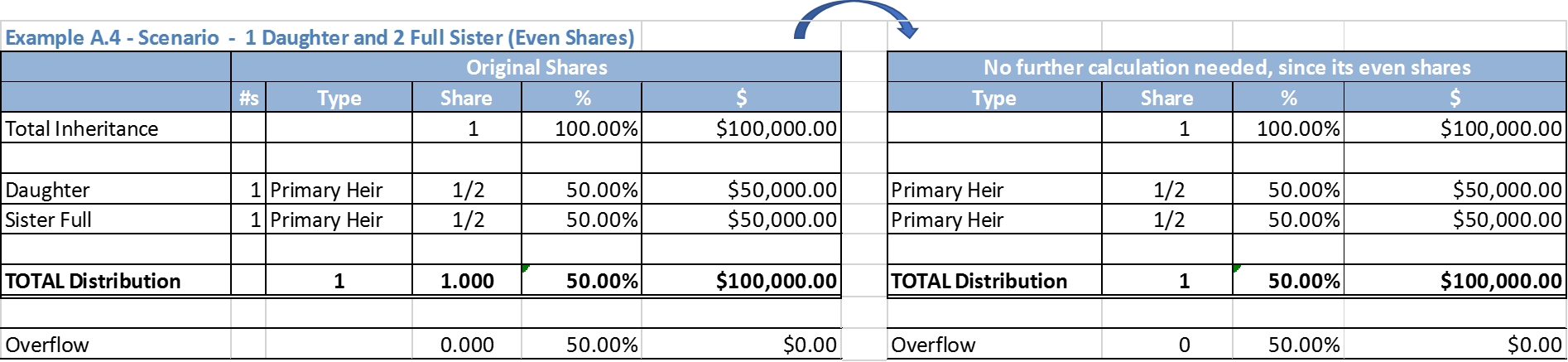

A.4 Example: 1 Daughter and 2 Full Sister

- Heirs are: 1 Daughter and 1 Full Sister

- Total Estate for inheritance is $100,000.

- Since daughter and full sister are only heirs, they share all property

- One Daughter gets 1/2 share ($50,000)

- One Full Sister gets 1/2 share ($50,000)

A.4 Example: Even Shares

Examples of Father (as Ashab-ul-Furud)

- See following examples

- A. 5 Example: 1 Daughter, 1 Wife, 1 Father, 1 Mother

- A. 6 Example: 2 Daughters, 1 Husband, 1 Father, 1 Mother

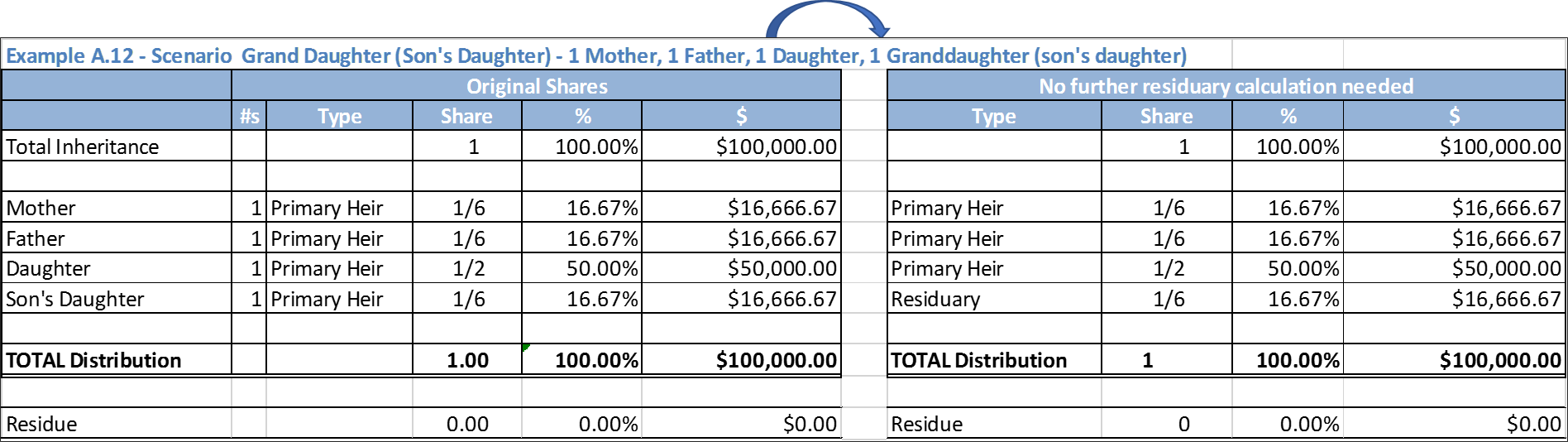

- A. 12 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Daughter

- A. 13 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Son

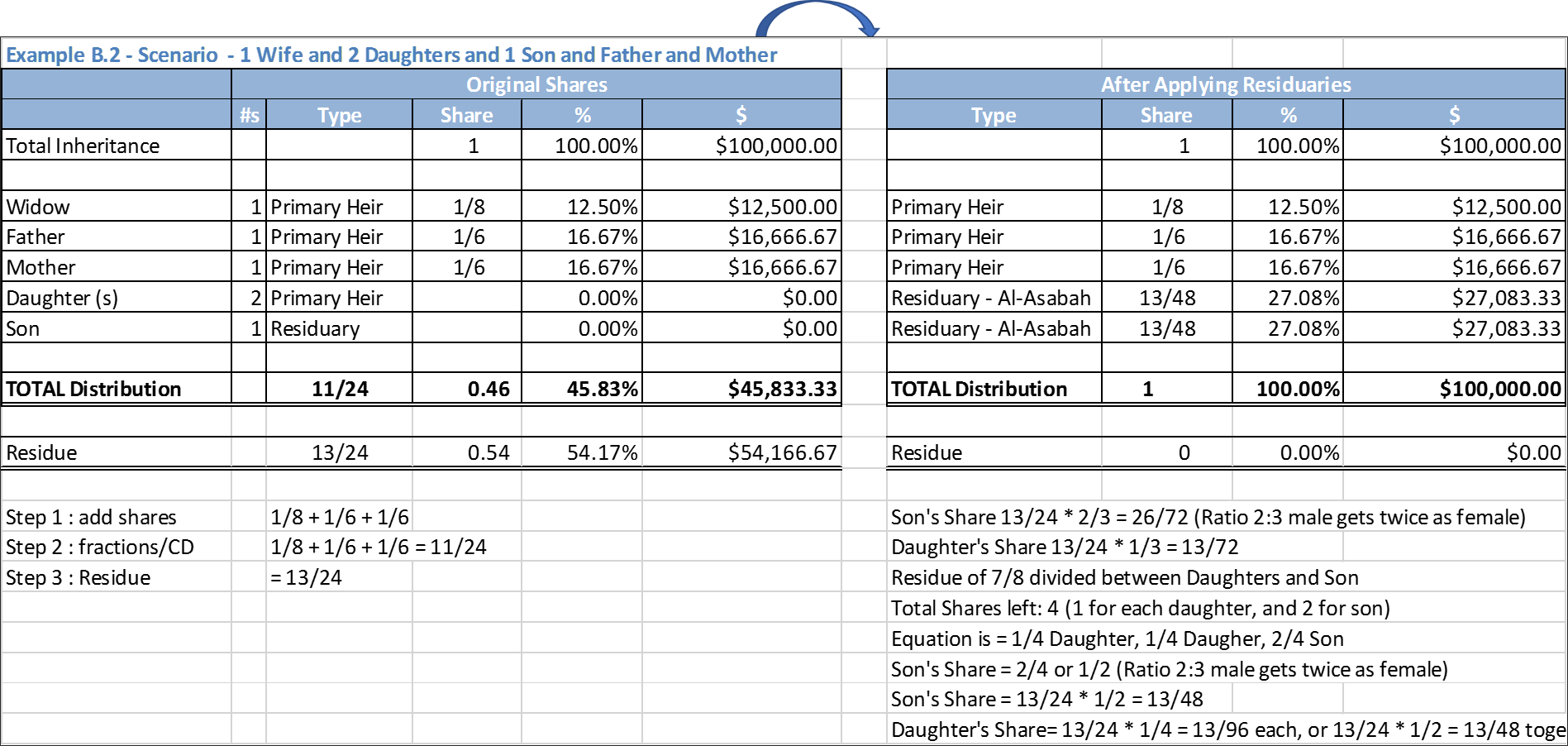

- B.2 Example: Wife, 2 Daughters, 1 Son, 1 Father, 1 Mother

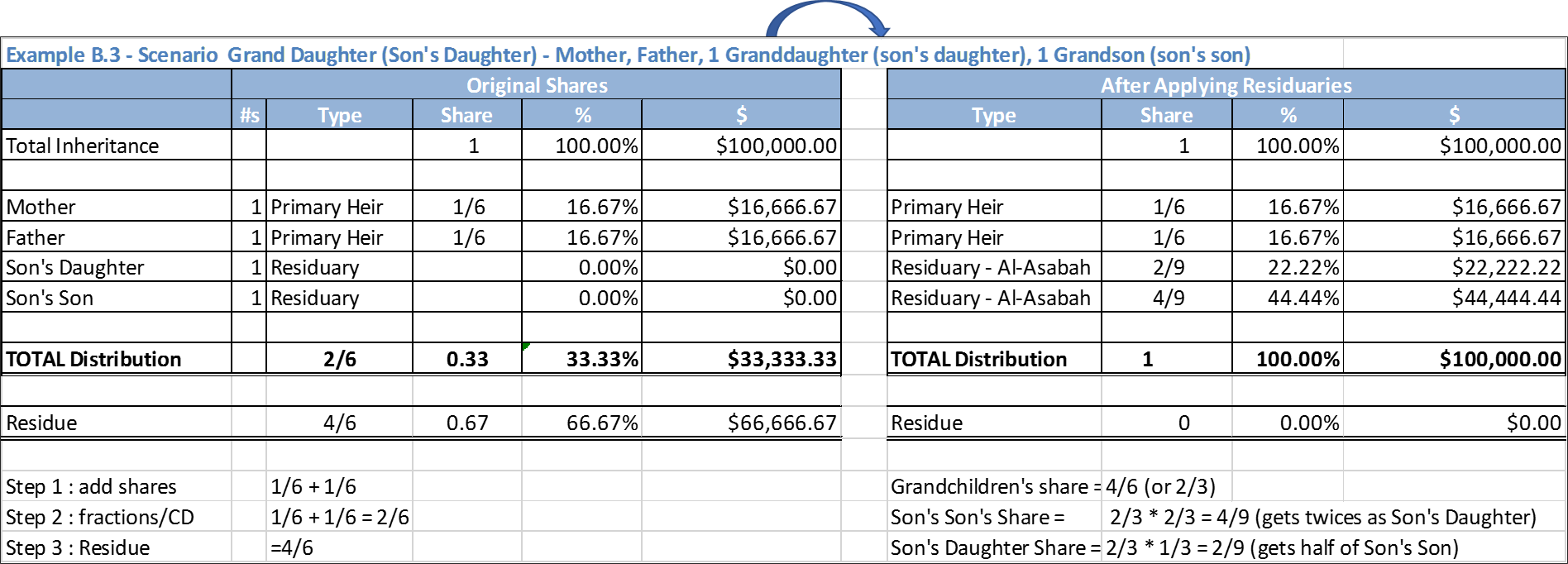

- B.3 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Son

Examples of Mother (as Ashab-ul-Furud)

- See following examples:

- A.2 Example: Wife, 2 Daughters, 1 Mother

- A.3 Example: Wife, 2 Daughters, 1 Mother, Father

- A. 5 Example: 1 Daughter, 1 Wife, 1 Father, 1 Mother

- A. 6 Example: 2 Daughters, 1 Husband, 1 Father, 1 Mother

- A. 8 Example: 1 Father’s Mother, 1 Mother’s Mother, 1 Mother, 1 Daughter, 1 Full Brother

- A. 10 Example: 2 Sisters, 1 Wife, 1 Mother

- A. 11 Example: 1 Granddaughter (son’s daughter), Husband, 1 Mother, 1 Brother

- B.2 Example: Wife, 2 Daughters, 1 Son, 1 Father, 1 Mother

- B.3 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Son

- B.4 Example: 1 Sister, 1 Wife, 1 Mother, 1 Daughter

Examples of Wife (as Ashab-ul-Furud)

- See following examples:

- A.1 Example: Wife, 2 Daughters

- A.2 Example: Wife, 2 Daughters, 1 Mother

- A.3 Example: Wife, 2 Daughters, 1 Mother, Father

- A. 5 Example: 1 Daughter, 1 Wife, 1 Father, 1 Mother

- A. 10 Example: 2 Sisters, 1 Wife, 1 Mother

- B.4 Example: 1 Sister, 1 Wife, 1 Mother, 1 Daughter

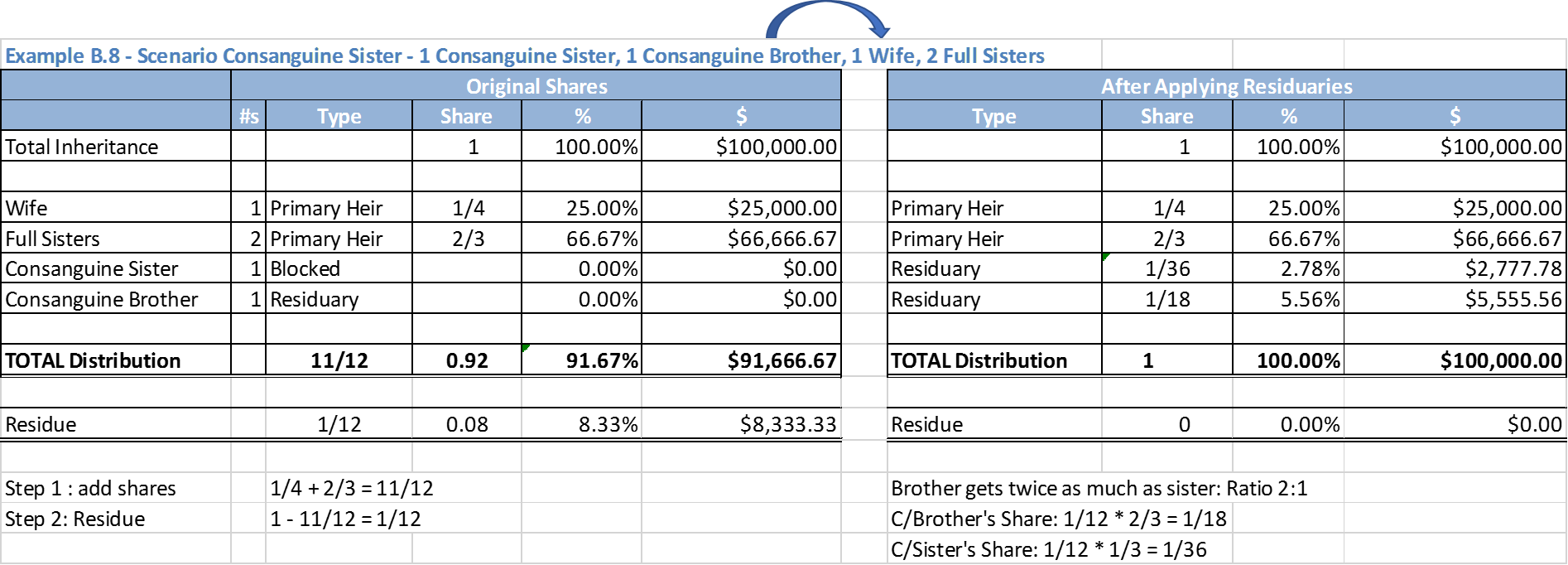

- B.8 Example: 1 Consanguine Sister, 1 Consanguine Brother, 1 Wife, 2 Full Sisters

- B.9 Example: 1 Consanguine Sister, 1 Uterine Sister, 1 Full Sister, 1 Wife, 1 Son’s Daughter

Examples of Husband (as Ashab-ul-Furud)

- See following examples:

- A. 6 Example: 2 Daughters, 1 Husband, 1 Father, 1 Mother

- A. 7 Example: 1 Father’s Mother, 1 Mother’s Mother, Husband, 1 Daughter, 1 Full Sister

- A. 11 Example: 1 Granddaughter (son’s daughter), Husband, 1 Mother, 1 Brother

- B.6 Example: 1 Sister, 1 Husband, 1 Daughter, 1 Son’s Daughter

- B.7 Example: 1 Sister, 1 Brother, 1 Husband, 1 Daughter

Examples of Daughter (as Ashab-ul-Furud)

A. 5 Example: 1 Daughter, 1 Wife, 1 Father, 1 Mother

- Heirs are: 1 Daughter, 1 Wife, 1 Father,1 Mother

- Wife gets 1/8 because there is a child (Daughter)

- Daughter gets her 1/2 because she is the only daughter

- Mother gets 1/6

- Father gets 1/6 and remainder of residue

- i.e. 1/8 + 1/2 + 1/6 + 1/6 = 23/24

- Father’s additional residue share is (1 – 23/24) = 1/24

- Father’s total share is (1/6 + 1/24) = 5/24

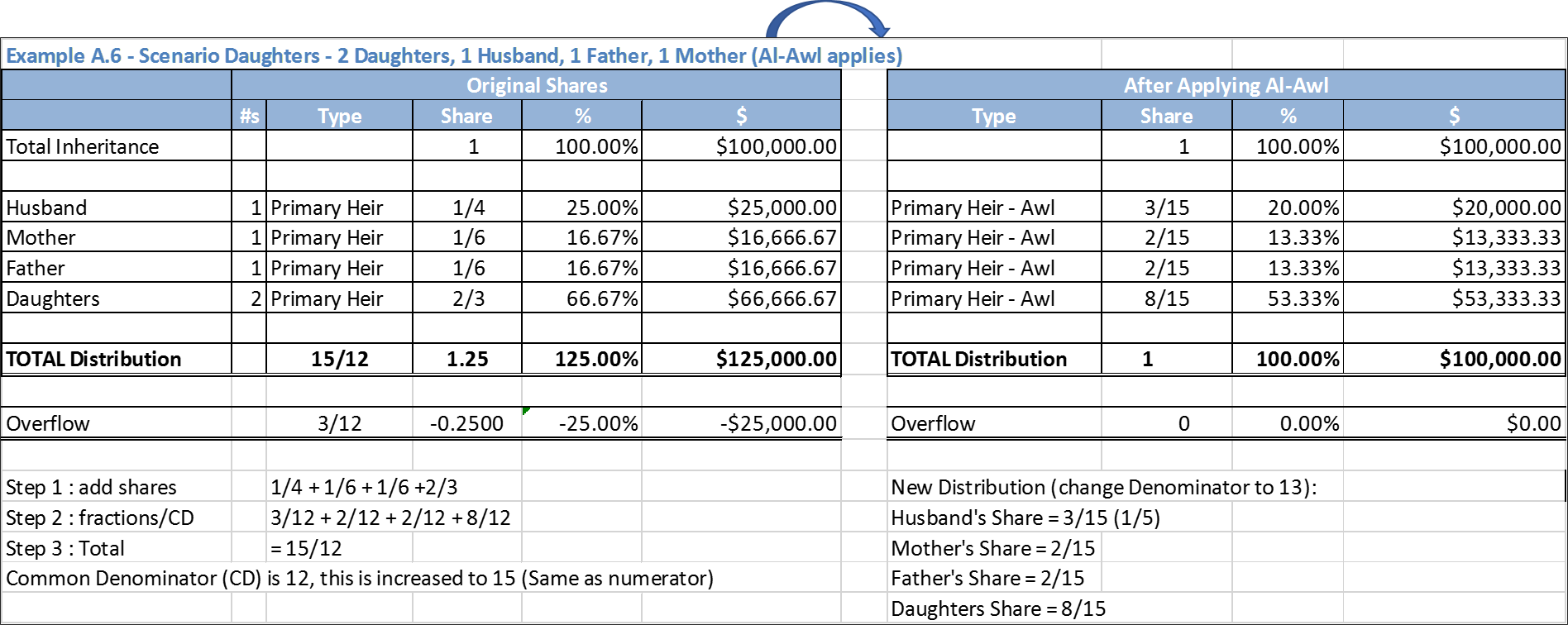

A. 6 Example: 2 Daughters, 1 Husband, 1 Father, 1 Mother

- Heirs are: 2 Daughters, 1 Husband, 1 Father, 1 Mother

- Husband gets 1/4 because there is a child (Daughters)

- Daughter gets her 2/3 because she are two daughters

- Mother gets 1/6

- Father gets 1/6

- Since total sum (1/4 + 2/3+ 1/6 + 1/6) is 15/12 and exceed the available shares, we will apply Doctrine of Al-Awl. See chart for revised shares.

A.6 Example: Daughters

Examples of True Grandmother (as Ashab-ul-Furud)

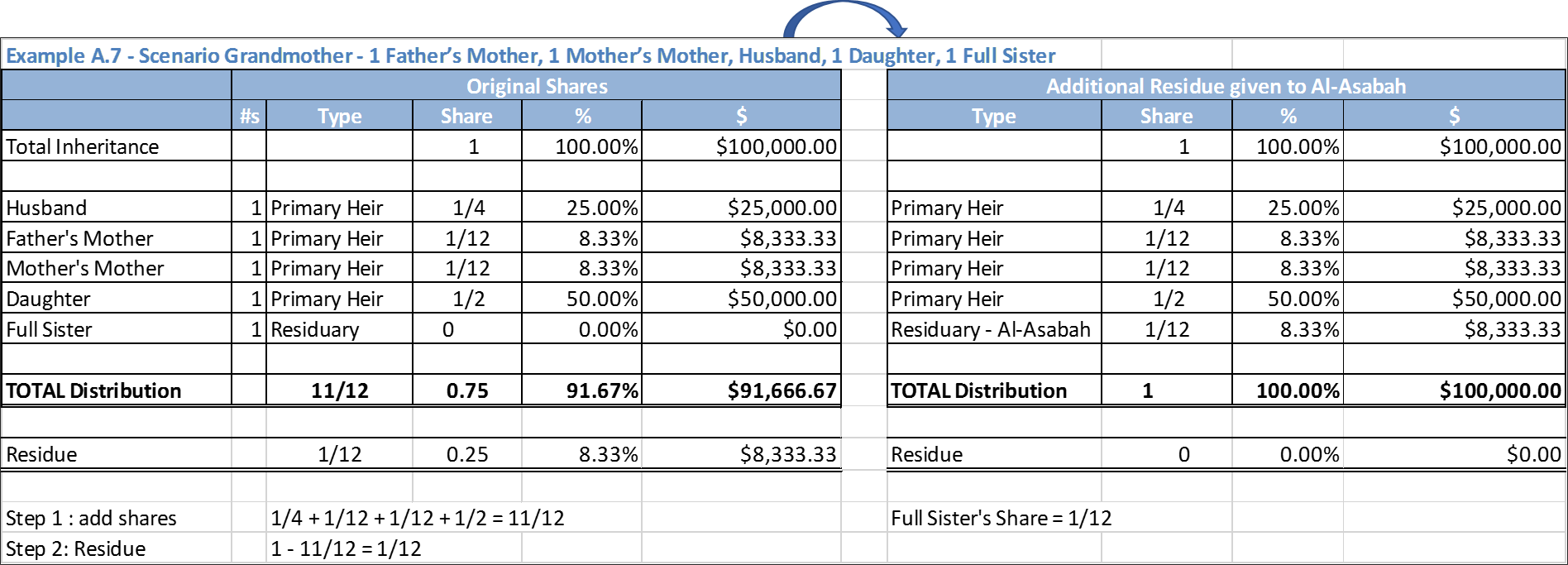

A. 7 Example: 1 Father’s Mother, 1 Mother’s Mother, Husband, 1 Daughter, 1 Full Sister

- Heirs are: 1 Father’s Mother, 1 Mother’s Mother, Husband, 1 Daughter, 1 Full Sister

- Husband gets 1/4 because there is a child (Daughter)

- Daughter gets her ½ because she is the only daughter

- Grandmothers (both) get 1/6 as there is no mother. i.e. 1/12 each.

- Full Sister will be Al-Asabah ma’a ghayriha (العصبة ما غيرها) with daughter. She will get remainder of shares.

- i.e. 1/4 + 1/2 + 1/6 = 11/12

- Hence, Full sister’s share is (1 – 11/12) = 1/12

A.7 Example: True Grandmother

A. 8 Example: 1 Father’s Mother, 1 Mother’s Mother, 1 Mother, 1 Daughter, 1 Full Brother

- Heirs are: 1 Father’s Mother, 1 Mother’s Mother, 1 Mother, 1 Daughter, 1 Full Brother

- Mother gets 1/6

- Daughter gets her 1/2 because she is the only daughter

- Grandmothers (both) get nothing as they are blocked by Mother.

- Full Brother gets the residue

- i.e. 1/6 + 1/2 = 2/3

- F/Brother’s share (1 – 2/3) = 1/3

A. 9 Example: 1 Father’s Mother, 1 Father’s Father, 1 Mother’s Grandmother (Mother’s Mother’s Mother), 2 Daughters

- Heirs are: 1 Father’s Mother, 1 Father’s Father, 1 Mother’s Grandmother (Mother’s Mother’s Mother), 2 Daughters

- Daughters get 2/3 as there are two daughters.

- Grandmother (Father’s mother) will get 1/6

- Grandfather (Father’s father) will get 1/6 and remainder of Residue

- i.e. 2/3 + 1/6 + 1/6 = 1

- Since there is no residue, Grandfather get 1/6 only.

- Maternal Great Grand Mothers (Mother’s Mother’s Mother) is blocked by Grandmother (Father’s mother) and get no share.

- Maternal GG-Mother is blocked by Father’s Mother per Hanafi and Hanbali Fiqh

Examples of Grandfather (as Ashab-ul-Furud)

- See following examples:

- A. 9 Example: 1 Father’s Mother, 1 Father’s Father, 1 Mother’s Grandmother (Mother’s Mother’s Mother), 2 Daughters

Examples of Uterine Brother/Sister (as Ashab-ul-Furud)

Examples of Full Sister (as Ashab-ul-Furud)

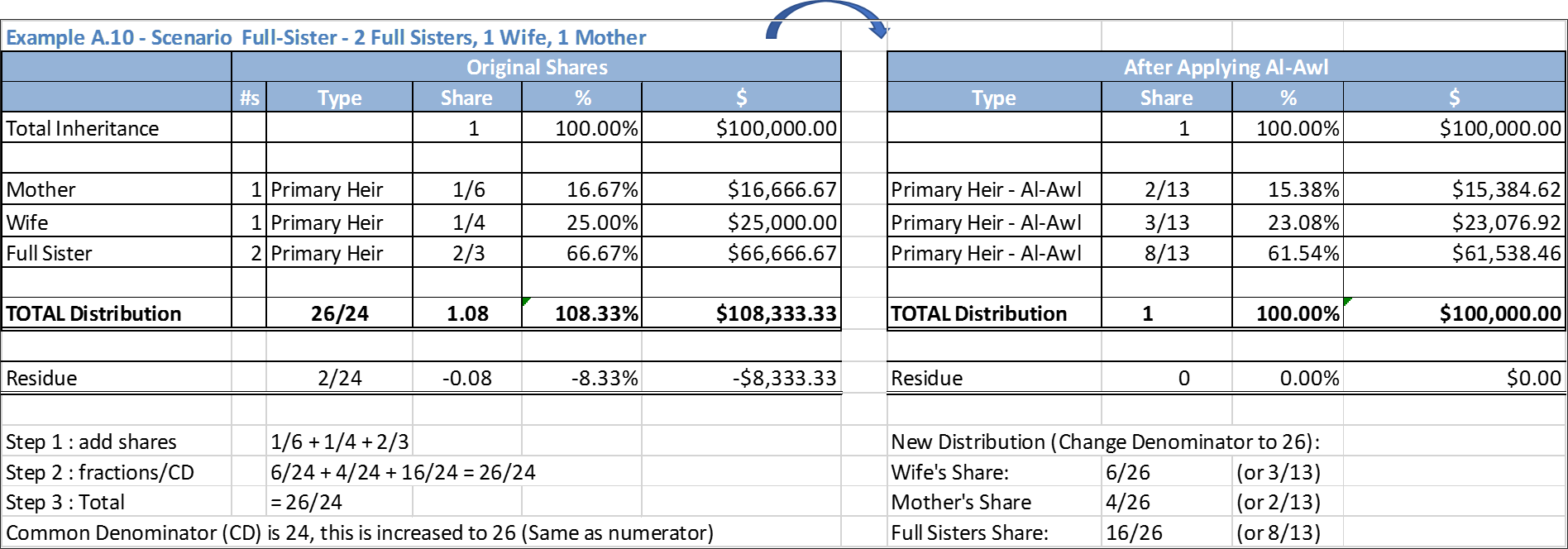

A. 10 Example: 2 Sisters, 1 Wife, 1 Mother

- Heirs are: 2 Sisters, 1 Wife, 1 Mother

- Mother gets 1/6 because there are two sisters

- Wife get 1/4 because there is no child

- Two Sisters will share as Primary Heir as there is no excluder for her. Their collective share is 2/3.

- We also apply Doctrine of Al-Awl to distribute overflow 26/24 of the share, i.e. 2/24 (-$8,333.33), by changing denominator to 26.

- New distribution will be Wife: 6/26 (or 3/13), Mother 4/26 (or 2/13), Sisters 16/26 (or 8/13, i.e. 4/13 each)

A.10 Example: Full Sisters

Examples of Consanguine Sister (as Ashab-ul-Furud)

Examples of Grand Daughter – Son’s Daughter (as Ashab-ul-Furud)

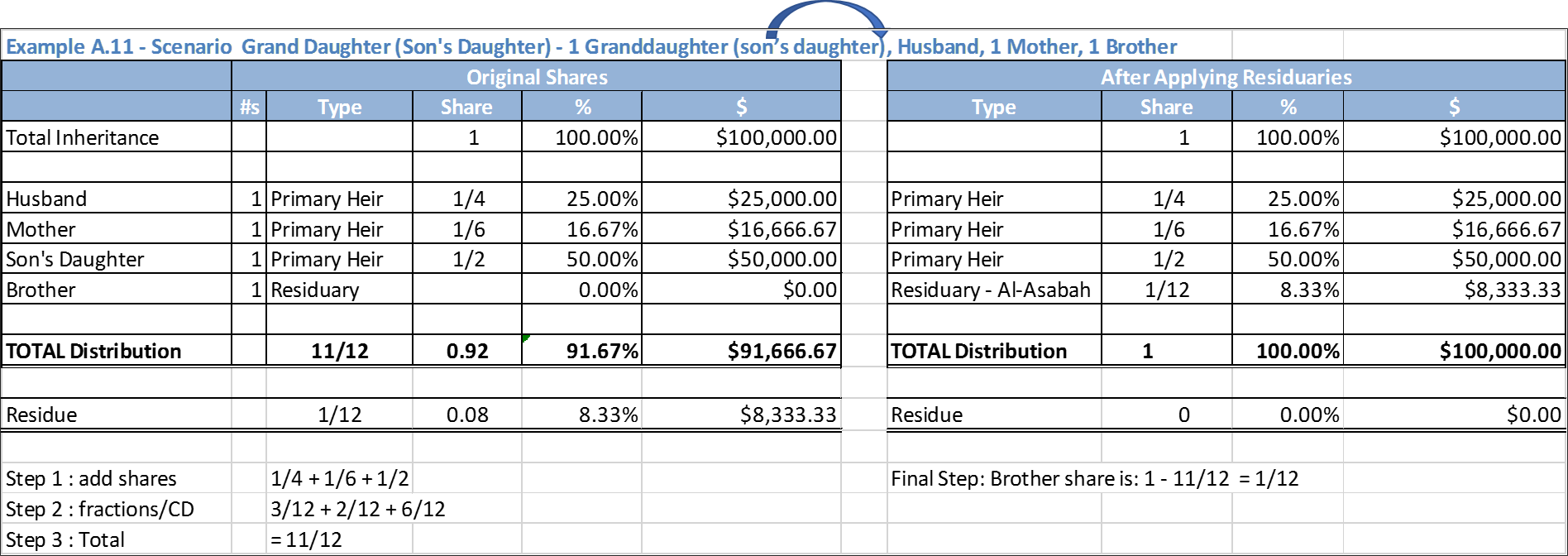

A. 11 Example: 1 Granddaughter (son’s daughter), Husband, 1 Mother, 1 Brother

- Heirs are: 1 Granddaughter (son’s daughter), Husband, 1 Mother, 1 Brother

- Husband regular share is 1/2, but he gets 1/4 because there is child (Son’s Daughter)

- Mother gets 1/6 because there is child (Son’s Daughter)

- Son’s Daughter gets 1/2 because she is only Child (descendant)

- Brother is Al-Asabah (residuary), he will get only what remains of primary heirs.

A.11 Example: Grand Daughter

A. 12 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Daughter

- Heirs are: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Daughter

- Father gets 1/6 because there is child (Daughter and Son’s Daughter)

- Mother gets 1/6 because there is child (Daughter and Son’s Daughter)

- Daughter gets 1/2 because she is only Daughter

- Son’s Daughter gets 1/6 because there is One Daughter. If there were two daughters then granddaughter would be excluded.

A.12 Example: Grand Daughter

A. 13 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Son

- Heirs are: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Son

- Father gets 1/6 because there is child (Son and Son’s Daughter)

- Mother gets 1/6 because there is child (Son and Son’s Daughter)

- Son gets remainder of the state as Residuary

- Son’s Daughter is excluded as she is blocked by Son. Case of Totally Excluded (حجب حرمان).

See example “Examples of Grand Daughter – Son’s Daughter (as Al-Asabah)

B.3 Example: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Grand Son (Son's Son)

- Heirs are: 1 Granddaughter (Son’s Daughter), 1 Mother, 1 Father, 1 Grand Son (Son's Son)

- Where Granddaughter gets a lucky share due to Grandson.

- Father gets 1/6 because there is grand son

- Mother gets 1/6 because there is grand son

- Grand Son and Grand Daughter will take residue with ratio 2:1

- Grand Son gets 4/9, Daughter gets 2/9

B.3 Example: Grand Daughter

B. INHERITANCE IS DISTRIBUTED AMONGST DHUL-FURUD (ذو الفروض) AND AL-ASABAH AL-NASABIYYAH (العصبة نسبية)

Examples of Son and Daughter together

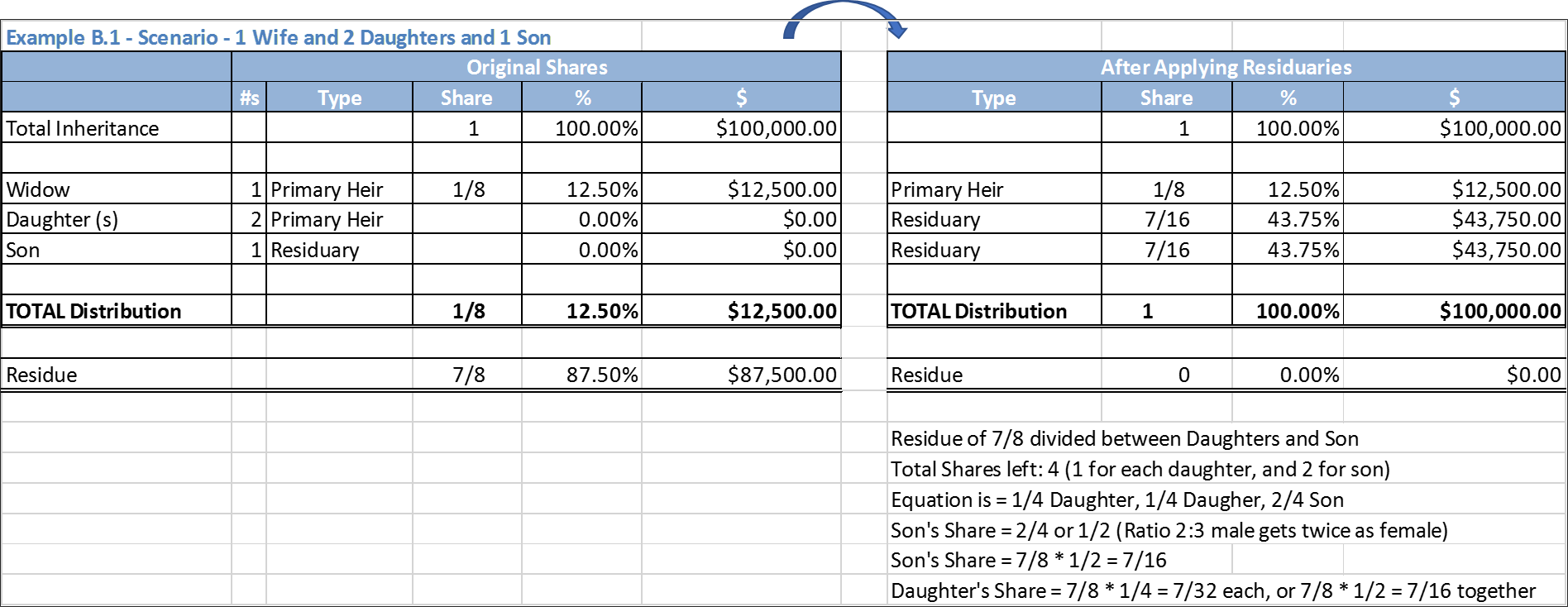

B.1 Example: Wife, 2 Daughters, 1 Son

- Heirs are: 1 Wife and 2 Daughters and 1 Son (Son turns Daughter into Residuary)

- Total Estate for inheritance is $100,000

- Widow’s regular share is 1/4, but due to child her share is 1/8 ($12,500)

- Because of Son, Daughters will be treated as Residuary. Son / Daughter ratio is 2:1

- Total shares = 1/8 ($12,500). Here Residue (left over) is 7/8 ($87,500).

- Since there are two daughters, Residue Shares are 4:

- 1 Daughter, 1 Daughter, 2 for Son

- Equation is 1/4 + 1/4 + 2/4

- Son share in Residue is = 7/8 x 1/2 = 7/16

- Daughter share in Residue is = 7/8 x 1/4 = 7/32 (Bother daughter collectively gets 7/16)

B.1 Example: 2 Daughters & 1 Son together

- (See above chart) Calculate Son and Daughter’s share.

- Son gets twice as daughter, hence, 7/8 * 2/4 = 14/32 ($43,750)

- Each Daughter gets half of son, hence, 7/8 * 1/4 = 7/32 ($21,875) (both daughters get $43,750)

B.2 Example: Wife, 2 Daughters, 1 Son, 1 Father, 1 Mother

- Heirs are: 1 Wife and 2 Daughters and 1 Son and 1 Father and 1 Mother

- Total Estate for inheritance is $100,000

- Widow’s regular share is 1/4, but due to child her share is 1/8 ($12,500)

- Father and Mother will get fixed 1/6 due to Children

- Because of Son, Daughters will be treated as Residuary. Son / Daughter ratio is 2:1

- Total fixed shares (1/8+1/6+1/6) = 11/24 ($45,833). Here Residue (left over) is 13/24 ($54,166).

B.2 Example: 2 Daughters & 1 Son together

- (See Above) Calculate Son and Daughter’s share.

- Son gets twice as daughter, hence, 13/24 * 2/4 = 13/48 ($27,083.33)

- Daughter gets half of son, hence, 13/24 * 1/4 = 13/96 ($13,541.67) (both Daughters get $27,083.33)

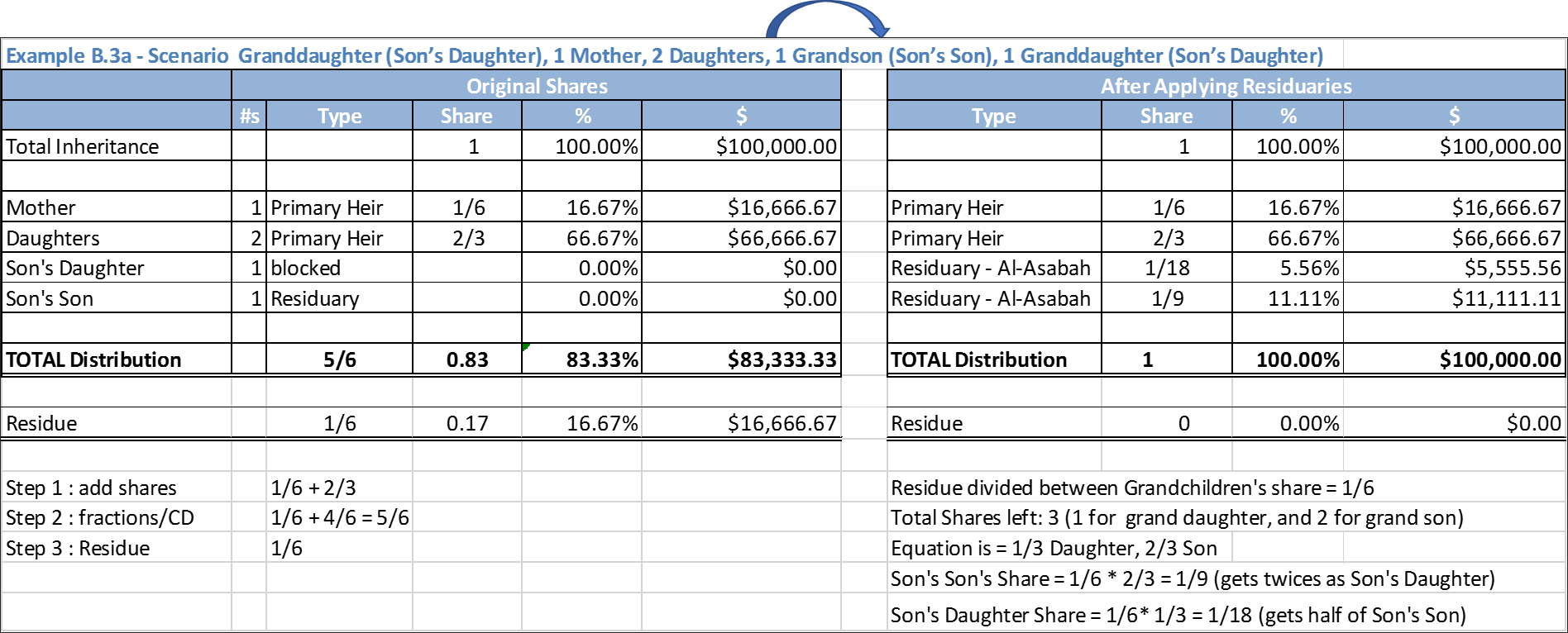

B.3a Example: Granddaughter (Son’s Daughter), 1 Mother, 2 Daughters, 1 Grandson (Son’s Son), 1 Granddaughter (Son’s Daughter)

- Heirs are: 1 Granddaughter (Son’s Daughter), 1 Mother, 2 Daughters, 1 Grandson (Son’s Son), 1 Granddaughter (Son’s Daughter)

- Mother gets 1/6 because there is child (Daughters and Grandchildren)

- 2 Daughters get joint share of 2/3

- When there are 2 daughters, granddaughter is excluded/blocked. However, in this situation Granddaughter (Son’s Daughter) became lucky Al-Asabah (residuary) due to Grandson (Son’s Son). She gets half of Son’s share.

- Between Grand Daughter and Grand Son they share remaining 1/6 (GD gets 1/18, GS gets 1/9).

- Please remember that Grand son turns Grand Daughter into a residuary.

B.3A Example: 2 Daughters, 1 Grand Daughters & 1 Grand Son together

Examples of Sister (as Al-Asabah)

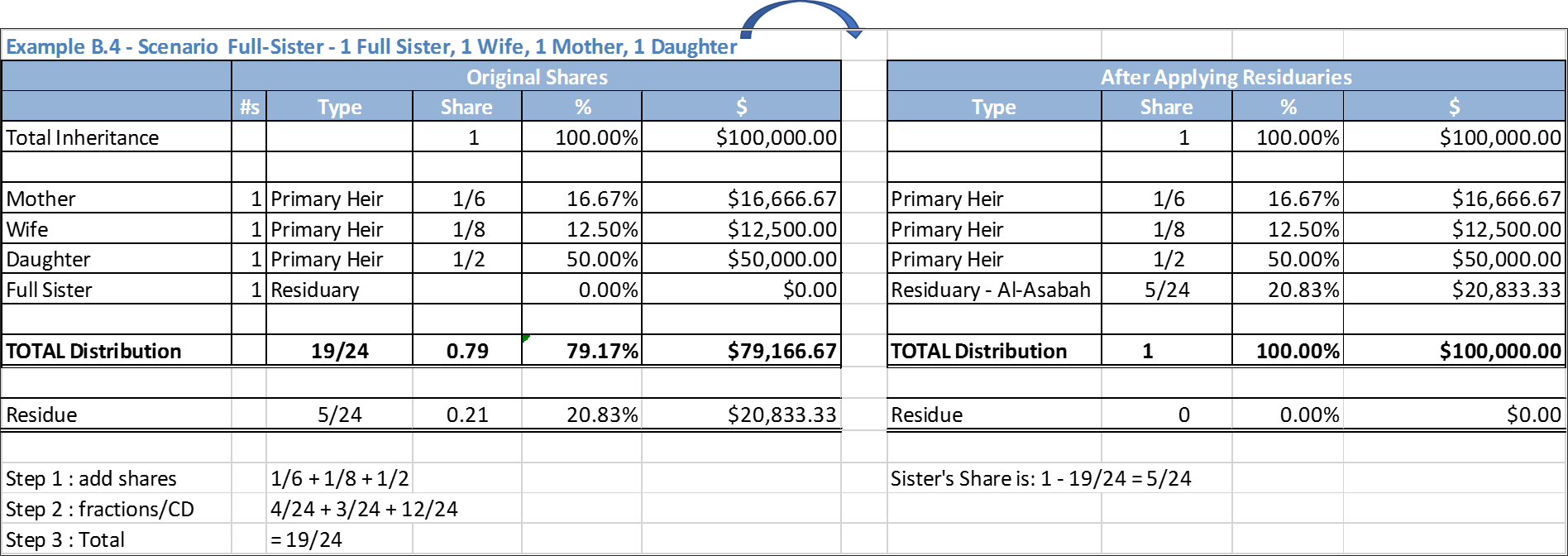

B.4 Example: 1 Sister, 1 Wife, 1 Mother, 1 Daughter

- Heirs are: 1 Sister, 1 Wife, 1 Mother, 1 Daughter

- Mother gets 1/6 because there is child (Daughter)

- Wife get 1/8 because there is child (Daughter)

- Daughter gets 1/2 because she is the only Daughter

- Full sister gets remainder as Residuary - Al-Asabah ma’a ghayriha (العصبة ما غيرها).

B.4 Example: Sisters

B.5 Example: 2 Sisters, 2 Daughters

- Heirs are: 2 Sister, 2 Daughter

- 2 Daughters get 2/3 as their fixed share (1/3 each)

- 2 Full Sisters gets 1/3 as residuary (1/6 each). i.e. 1 – 2/3 = 1/3

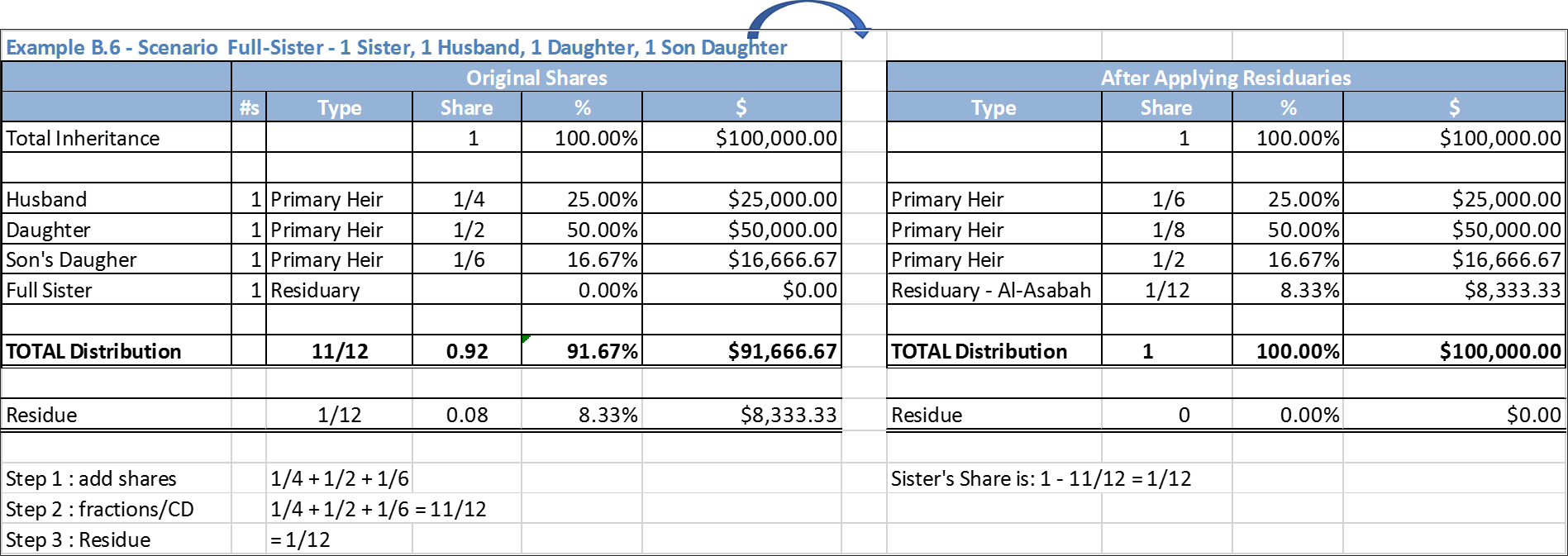

B.6 Example: 1 Sister, 1 Husband, 1 Daughter, 1 Son’s Daughter

- Heirs are: 1 Sister, 1 Husband, 1 Daughter, 1 Son Daughter

- Husband gets 1/4 because there is children

- 1 Daughter gets 1/2 as she is the only Daughter

- 1 Son’s Daughter gets 1/6 because there is a Daughter

- 1 Sister gets 1/12 as Residuary - Al-Asabah ma’a ghayriha (العصبة ما غيرها). i.e. 1/4 + 1/2 + 1/6 = 3/12 + 6/12 + 2/12 = 11/12. Hence 1 – 11/12 = 1/12 Remaining residue.

B.6 Example: Sisters

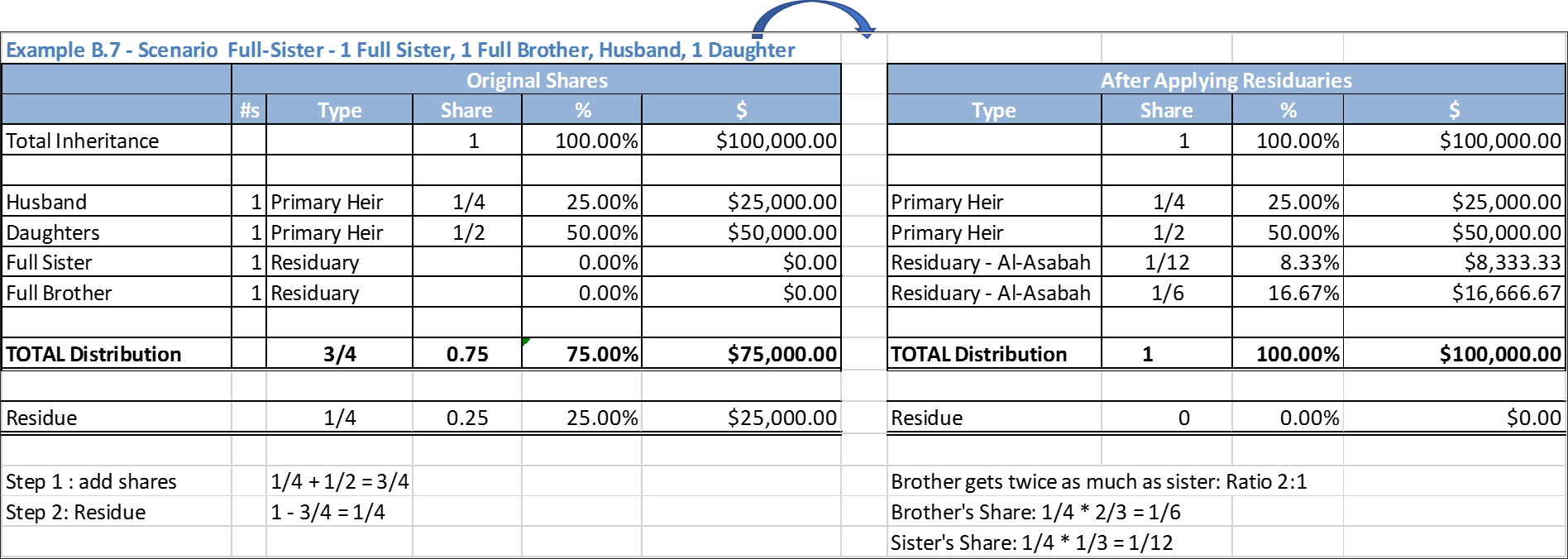

B.7 Example: 1 Sister, 1 Brother, 1 Husband, 1 Daughter

- Heirs are: 1 Sister, 1 Brother, 1 Husband, 1 Daughter

- Husband gets 1/4 because there is children

- 1 Daughter gets 1/2 as she is the only Daughter

- Brother converts sister as residuary, hence they share remaining 1/4 between them. Brother gets twice as much as sister.

B.7 Example: Sisters

Examples of Consanguine Sister (as Al-Asabah)

B.8 Example: 1 Consanguine Sister, 1 Consanguine Brother, 1 Wife, 2 Full Sisters

- Heirs are: 1 Consanguine Sister, 1 Consanguine Brother, 1 Wife, 2 Full Sisters

- Wife gets 1/4 because there is no child

- Two Full Sister gets 2/3 as Primary heirs in the absence of ascendants/descendants

- Normally Consanguine sister is blocked by Full Sisters, but she gets lucky due to consanguine brother. The C/brother turns C/sister into Residuary - Al-Asabah bighayriha (العصبة بغيرها).

- C/brother and C/sister will share remaining residue, i.e. 1 – (1/4 + 2/3) = 1/12 residue. C/brother gets twice as much as c/sister.

B.8 Example: Consanguine Sisters

B.9 Example: 1 Consanguine Sister, 1 Uterine Sister, 1 Full Sister, 1 Wife, 1 Son’s Daughter

- Heirs are: 1 Consanguine Sister, 1 Uterine Sister, 1 Full Sister, 1 Wife, 1 Son’s Daughter

- Wife gets 1/8 because there is child (Son’s Daughter)

- Son’s Daughter will get 1/2 because she is the only daughter.

- Full Sister will get remainder of the residue as Al-Asabah ma’a ghayriha (العصبة ما غيرها). Full Sister’s share is 3/8, i.e. 1/8 + 1/2 = 5/8, and 1 – 5/8 = 3/8.

- Consanguine Sister is blocked by Full Sister.

- Uterine Sister is blocked by Son’s Daughter

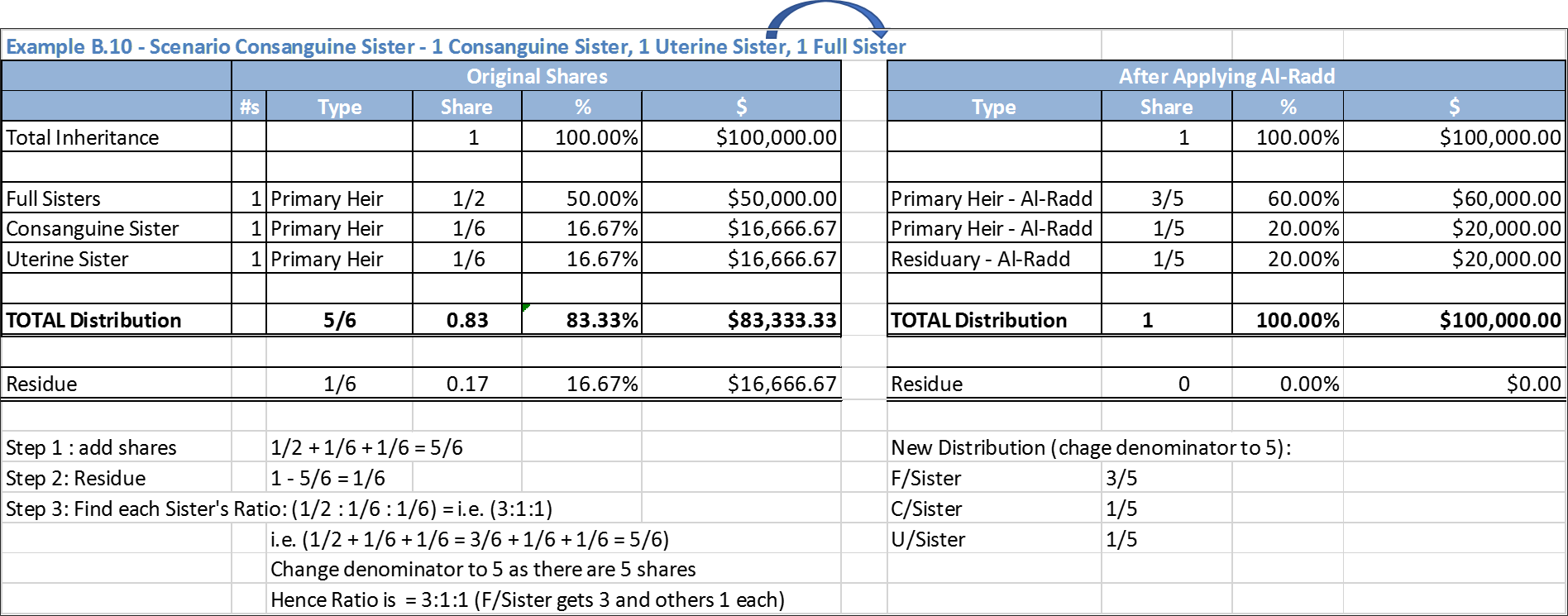

B.10 Example: 1 Consanguine Sister, 1 Uterine Sister, 1 Full Sister

- Heirs are: 1 Consanguine Sister, 1 Uterine Sister, 1 Full Sister

- Full Sister gets 1/2 as Primary heir

- Uterine Sister gets 1/6 because she is only one.

- Consanguine Sister gets 1/6

- Total share are: 1/2 + 1/6 + 1/6 = 5/6, leaving 1/6 residue.

- Doctrine of Al-Radd Applies giving additional shares. Ratio is 1/2 : 1/6 : 1/6 = (3:1:1) see below.

B.10 Example: Consanguine Sisters

Examples of Uterine Sister (as Al-Asabah)

B.11 Example: 1 Uterine Sister, 1 Uterine Brother, 1 Consanguine Sister, 1 Full Sister

- Heirs are: 1 Uterine Sister, 1 Uterine Brother, 1 Consanguine Sister, 1 Full Sister

- Full Sister gets 1/2 as Primary heir

- Consanguine Sister gets 1/6 (together with Full sister 1/2+1/6=2/3)

- Uterine Sister and Uterine Brother gets residue. i.e. 1 – (1/2 + 1/6) = 1/3

- In case of Uterine Brother/Sister the rule of male gets twice as female doesn’t apply. Hence, both Uterine Brother and Sister gets 1/6 each (1/6+1/6=1/3)

Examples of Full Brother (as Al-Asabah)

B.12 Example: 1 Full Brother, 1 Full Sister, 1 Consanguine Brother, 1 Consanguine Sister

- Heirs are: 1 Full Brother, 1 Full Sister, 1 Consanguine Brother, 1 Consanguine Sister

- Full Brother gets 2/3 of the estate, twice as much as Full Sister

- Full Sister gets 1/3 of the estate, half of Full Brother

- Consanguine Brother/Sister are blocked by Full Brother.

C. Inheritance is distributed only amongst Al-Asabah Nasabiyyah (العصبة نسبية)

D. Inheritance is distributed amongst Dhawul-Arham (ذو الرحام)

FOOTNOTES